Track Record

Total returns

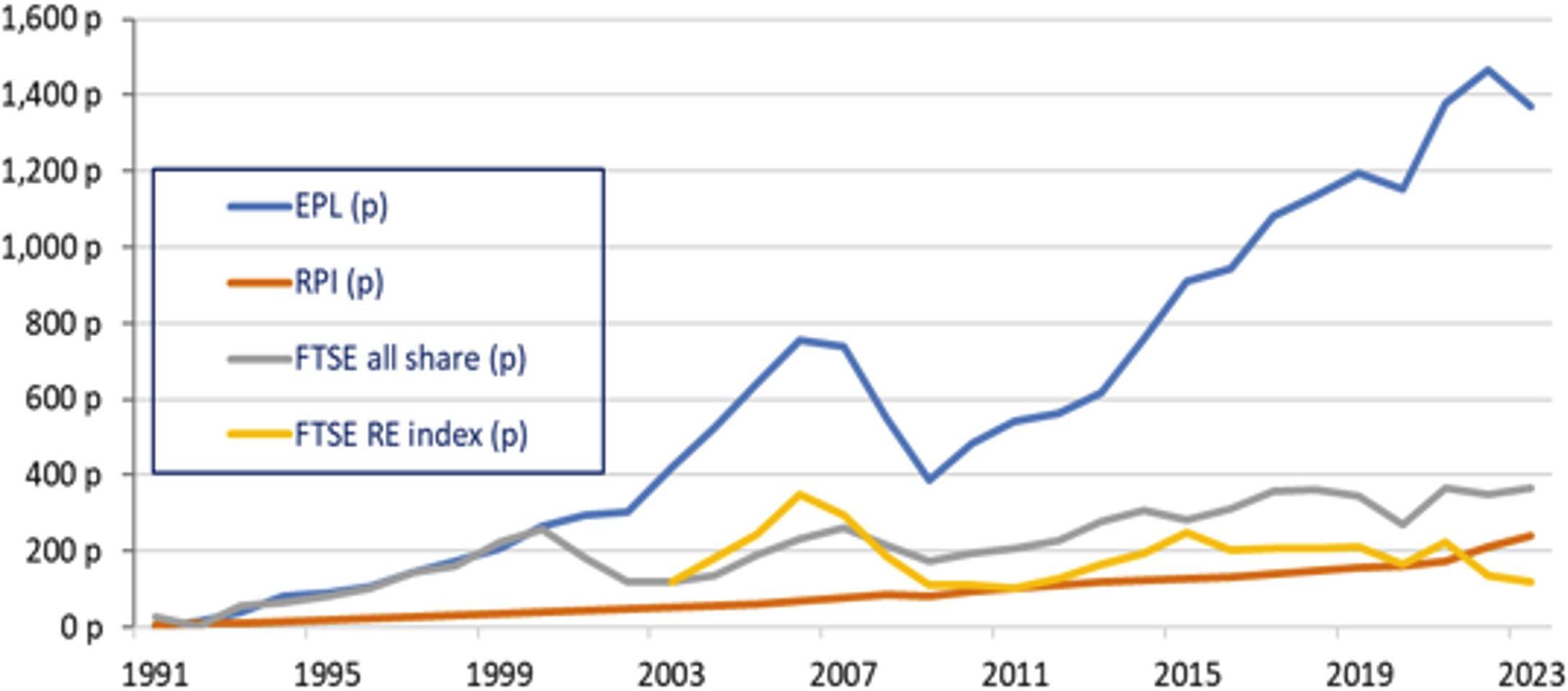

An 11.45% annualised total return has been achieved since inception.

Growth & Diversity

The £16m initial investment in Eskmuir in 1990 has grown to over £167m of shareholders funds in 2023. This is over 3.4 times the level of growth that would have been delivered through RPI.

Since 1990, Eskmuir has grown to over £300m of direct property investments with a further c.£100m of third party funds under management. The portfolio comprises over 300 tenancies across c.40 properties within the three principal commercial property sectors located in the major UK regions.

Distributions

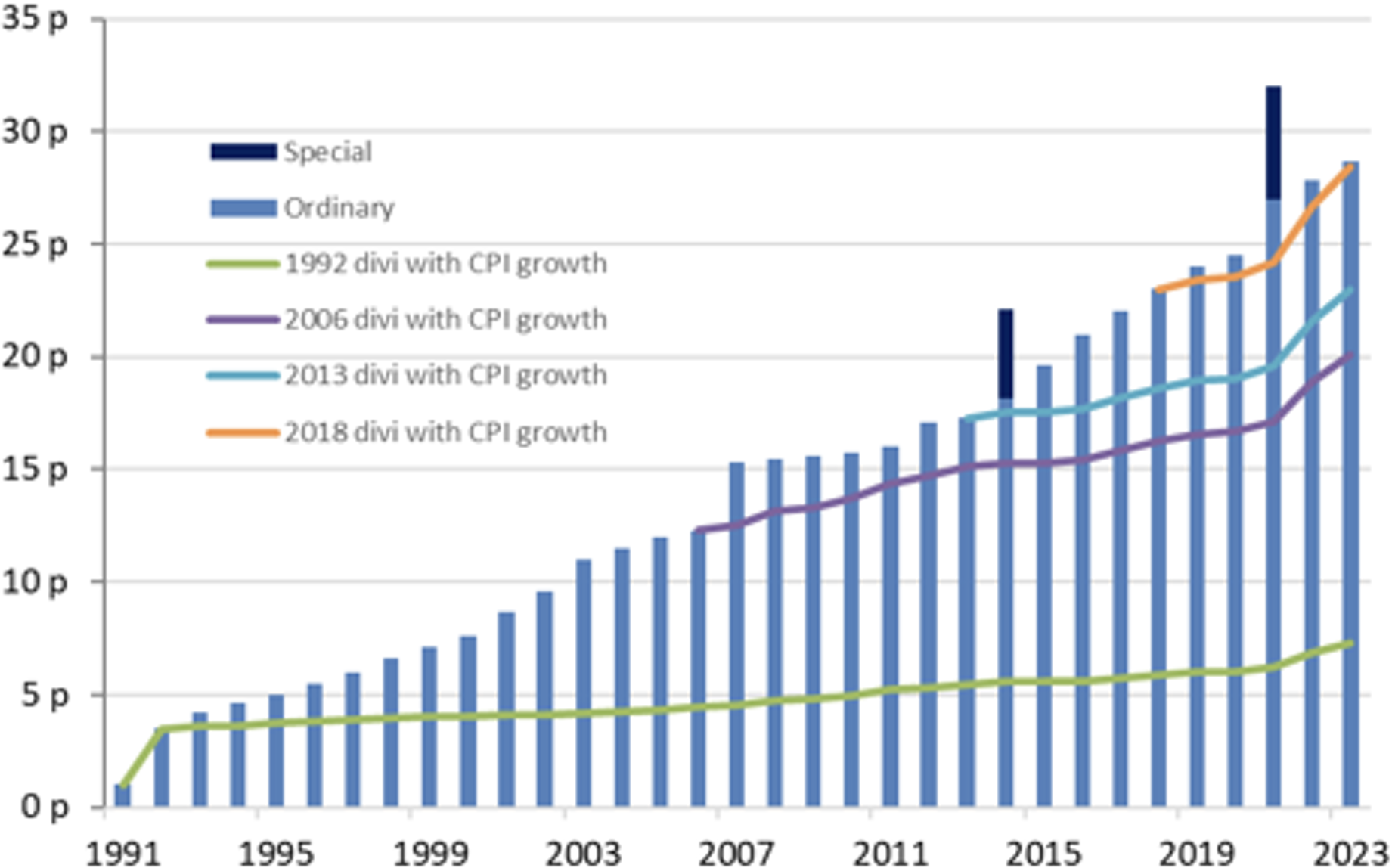

Eskmuir has delivered 33 successive years of dividend growth to its investors with the dividend on the seed investment averaging c.13.7% pa

Income Focus

Eskmuir’s income focussed approach to real estate management has delivered returns in excess of industry benchmarks due to its occupier base with robust financial covenants, strong locations with targeted weightings towards performing sectors aligned to economic, social and occupier trends and a focus on mitigating property risks whilst driving returns.